By:

Cale

McDowell,

William

H. Hornberger and

Ronald

D. KerridgeThe Office of Chief

Counsel of the Internal Revenue Service (the

"

IRS") recently issued internal

guidance in the form of a Chief Counsel Advice

(the "

CCA") indicating that the

IRS has taken the position that the "limited

partner" exception to the self-employment tax is

not available to members of an investment

management company earning fee income from

investment funds under its

management.

1

Background The Internal

Revenue Code ("

IRC")

provides consistent tax compliance

rules for wages earned by an employee,

which are taxed under the Federal Insurance

Contribution Act ("

FICA"), and

earnings from self-employment, which are taxed

under the Self-Employment Contribution Act

("

SECA"). FICA is comprised of a

12.4% tax on wages, up to an annual cap, and a

2.9% uncapped Medicare tax on wages (or 3.8% for

wages over a threshold amount).

2 One

half of the FICA tax is borne by the employer

and is deductible, while the other half is borne

by the employee and may not be deducted. SECA

follows a parallel structure, with a 12.4% tax

on net earnings from self-employment

("

NESE"), up to an

annual cap, and a 2.9% uncapped Medicare

tax on NESE (or 3.8% for NESE over a threshold

amount).

3 One half of the SECA tax

may be deducted by self-employed individuals.

In addition to the 0.9% increase in the

uncapped Medicare component of the FICA and SECA

taxes, IRC Section 1411 now imposes an

additional 3.8% net investment income tax

("

NIIT") on unearned income that

would not have previously been taxable as wages

under FICA or as NESE under SECA. With the

potential for a significantly increased tax

burden as a result of these recent changes, many

private equity and hedge fund managers have

struggled to understand the extent to which the

SECA and NIIT taxes apply to the various forms

of income that are typical in their businesses.

The CCA sheds some light on the position taken

by the IRS with respect to fees earned for

investment management services.

The

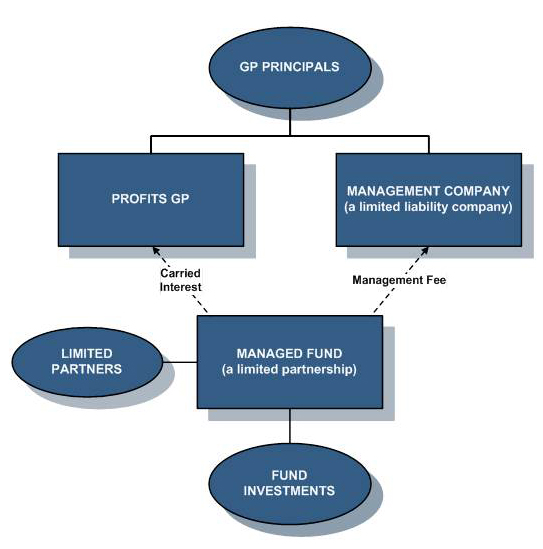

Chief Counsel Advice The subject of

the CCA is a family of hedge funds (the

"

Managed Fund") with the following

attributes:

- Each partnership comprising the Managed Fund

has two general partners:

- A state law limited liability company

treated as a partnership for Federal tax

purposes (the "Management

Company") serves as a general partner of

the Managed Fund and as its investment manager.

The Management Company is responsible for

carrying out the investment activities of the

Managed Fund and is entitled to a quarterly

management fee calculated on the basis of assets

under management. The management fee is the

Management Company's primary source of

income.

- A separate entity (the "Profits

GP") serves as a general partner of the

Managed Fund and generally does not take part in

the conduct or control of the Managed Fund's

activities but has a substantial interest in the

Managed Fund's gains and losses by virtue of its

carried interest.4

- A group of individuals (the "GP

Principals") are partners in the Profits

GP and the Management Company. Each of the GP

Principals works full time for the Management

Company and, together with employees of the

Management Company, provides investment

management services to the Managed Fund on

behalf of the Management Company.

- The limited partners of the Managed Fund are

passive investors and have no right to

participate in the control of the Managed

Fund.

The

question at issue in the CCA is whether a GP

Principal's distributive share of the management

fee income earned by the Management Company is

subject to the SECA tax.

5

Specifically, the CCA is an interpretation of

the "limited partner" exception to the SECA tax

set forth in IRC Section 1402(a)(13).

History of the Limited Partner

Exception NESE, the net

self-employment earnings subject to the SECA

tax, is generally defined as the gross income

derived by an individual from any trade or

business carried on by such individual, less

certain deductions attributable to such trade or

business, and generally includes the

individual's distributive share of income or

loss from any trade or business carried on by a

partnership of which that individual is a

member.

6 Thus, a GP Principal's

distributive share of the Management Company's

fee income would have clearly been included

within the meaning of NESE, and therefore

subject to the SECA tax, were it not for IRC

Section 1402(a)(13) (the "

limited partner

exception"), which excludes from NESE

the distributive share of any item of income or

loss of a limited partner, other than IRC

Section 707(c) guaranteed payments in the nature

of remuneration for services rendered.

The IRC does not define the term "limited

partner," and there has for many years been

substantial uncertainty surrounding the use of

that term. Section 1402(a)(13) was enacted in

1977, when the Revised Uniform Limited

Partnership Act of 1976 ("

RULPA")

and most state limited partnership statutes

provided that a limited partner would lose its

limited liability protection if it took part in

the control of the partnership's business. Since

that time, the Uniform Limited Partnership Act

of 2001 ("

2001 ULPA") has

eliminated this rule in favor of broad

protection for limited partners against entity

obligations, taking the position that "in a

world with LLPs, LLCs and, most importantly,

LLLPs, the rule is an anachronism."

7

As the drafters of the 2001 ULPA suggested, the

landscape of business entities has evolved

significantly since the publication of RULPA,

notably through the proliferation of entities

such as limited liability companies, which are

generally treated as partnerships for federal

income tax purposes but provide limited

liability protection for all members, regardless

of the level of participation in and control

over the entity's business. Thus, if the

original rationale for the limited partner

exception in IRC Section 1402(a)(13) was to

exclude from NESE the income of a partner that

is essentially passive investment income, then

the IRS may take the view that reliance on a

person's state law classification as a "limited

partner" for that purpose is unworkable given

the approach of the 2001 ULPA and the increased

popularity of limited liability companies, which

offer no such bright-line distinctions between

those who may participate in the control of the

business and those who may not.

In

1997, the IRS promulgated proposed regulations

attempting to define "limited partner" for

Section 1402(a)(13) purposes. The proposed

regulations generally provide that an individual

should be treated as a limited partner unless

the individual: (i) has personal liability for

the debts of or claims against the partnership

by reason of being a partner, (ii) has authority

to contract on behalf of the partnership, (iii)

participates in the partnership's trade or

business for more than 500 hours, or (iv) is a

service provider in a "service partnership"

(

e.g., a law firm or accounting firm).

The proposed regulations would have applied to

all tax partnerships, including limited

liability companies. However, in response to

widespread criticism of the proposed

regulations, Congress imposed a temporary

moratorium on finalizing the proposed

regulations, and, even after the expiration of

the moratorium in 1998, the proposed regulations

have not been finalized.

In the absence

of final regulations, the limited partner

exception has been interpreted largely by the

courts. In

Renkemeyer, Campbell & Weaver,

LLP v. Commissioner, practicing attorney

partners in a law firm organized as a limited

liability partnership were found not to be

"limited partners" within the meaning of Section

1402(a)(13), due in part to their active

participation in the business generating the

income at issue, and were therefore subject to

self-employment taxes with respect to their

distributive shares of such income.

8

In

Riether v. United States, the district

court held that two members of a limited

liability company "are not members of a limited

partnership, nor do they resemble limited

partners, which are those who lack management

powers but enjoy immunity from liability for

debts of the partnership," and therefore granted

the government's motion for summary judgment,

finding that the members were subject to the

self-employment tax with respect to their

distributive shares of the LLC's

income.

9 The CCA represents

another effort by the IRS to clarify its

position with respect to the interpretation of

IRC Section 1402(a)(13). In analyzing the

legislative history of the limited partner

exception, the IRS finds that it was the intent

of Congress to exclude from the SECA tax

"earnings which are basically of an investment

nature," but not earnings deriving from a

partner's active participation in the

partnership's business operations.

10

Because the income earned by the GP Principals

from the Management Company is not in the nature

of a return on a passive capital investment, the

IRS determines that the GP Principals are not

"limited partners" for purposes of Section

1402(a)(13) and are therefore subject to the

SECA tax on their distributive shares of the

management fees. In so doing, the IRS appears to

follow the general approach of the 1997 proposed

regulations, which focus on the nature of the

taxpayer's interest and participation in the

partnership rather than state law entity

classifications.

11 The CCA

also disregards certain practices of the GP

Principals that would have heretofore been

viewed by some practitioners as reducing the

risk associated with reliance on Section

1402(a)(13). For example, the CCA indicates that

the GP Principals made material capital

investments in the Management

Company

12 and received portions of

their earnings as wages reported on Form W-2 and

as guaranteed payments, thus paying at least

some amount of SECA tax and withholding tax

under FICA.

13 However, the IRS

appears to consider these factors largely

irrelevant and instead focuses almost

exclusively on the active participation of the

GP Principals in the business of the Management

Company.

Conclusion and Potential

Impact Legal advice memoranda

such as the CCA do not constitute binding

precedent. However, if definitive authority were

ultimately to indicate that a management company

principal's distributive share of a management

company's fee income is NESE, then those amounts

would be subject to the SECA tax, including the

uncapped Medicare component

thereof.

14 Given the

non-binding nature of the CCA and the existence

of several competing proposals for reform of the

limited partner exception,

15 it is

impossible to determine how any definitive

authority might eventually develop. In the

meantime, it may be advisable for fund managers

to revisit their existing management company

structures to determine whether the use of an

alternative structure would better facilitate

their tax planning objectives.

For

additional information on this e-Alert, please

contact

Cale

McDowell (

cmcdowell@jw.com

or 512.236.2057),

Willie

Hornberger (

whornberger@jw.com

or 214.953.5857) or

Ron

Kerridge (

rkerridge@jw.com

or 214.953.5774 ).

1 ILM 201436049, Office of Chief

Counsel, Internal Revenue Service (September 5,

2014). Available

here.

2

The capped 12.4% component is known as the

Old-Age, Survivors, and Disability Insurance

Tax. The uncapped 2.9% component is known as the

Medicare Hospital Insurance Tax. Beginning in

2013, the uncapped 2.9% component was increased

by 0.9% to 3.8% for income over a threshold

amount (currently $250,000 for a joint return,

$125,000 for a married taxpayer filing

separately and $200,000 for a single return).

The additional 0.9% is not deductible under FICA

or SECA.

3 The basic

structure and threshold amounts referenced in

note 2 with respect to FICA are also applicable

to SECA.

4 The bifurcation of

the management fee and carried interest in

separate entities is a common state tax planning

strategy for fund managers with significant

operations in jurisdictions whose tax laws are

sensitive to the organizational structure of the

fund (such as the New York unincorporated

business tax or the Texas margin tax). However,

the analysis set forth herein would be similar

in the case of a single general partner

receiving both the carried interest and

management fee income.

5

Importantly, the CCA does not address the

applicability of the SECA tax or the NIIT to a

general partner's carried interest.

6 IRC Section

1402.

7 Uniform Limited

Partnership Act (2001), Prefatory Note. However,

this approach has not been adopted in every

state. Notably, both Texas and Delaware retain

some version of RULPA's limited partner control

rule, though with numerous safe harbors that

tend to limit its practical application.

8 136 T.C. 137

(2011).

9 919 F.Supp.2d 1140

(D. N.M. 2012).

10 H. Rept.

95-702 (Part 1), at 11

(1977).

11 While the facts

under review in the CCA involved GP Principals

who were state law limited liability company

members, and the CCA does not expressly indicate

that its conclusions would apply to state law

limited partners, the nature of the analysis in

the CCA may be independent of state law

classifications and intended for application

with respect to all tax partnerships regardless

of their organizational form under state law.

12 The lack of material

capital investments was cited in

Renkemeyer as a relevant factor in the

court's determination.

13

While the treatment of part of the GP

Principals' respective shares of management fees

as wages was inappropriate under Revenue Ruling

69-184, 1969-1 C.B. 256, which provides that a

partner cannot be an employee of his own

partnership, the IRS did not focus on this

issue, likely because the classification of a

portion of the fee income as wages would have

resulted in the Management Company withholding

FICA taxes with respect to such wages.

14 It seems clear, however,

in light of IRC Section 1411(c)(6), that no such

amounts should be subject to both the NIIT and

the SECA tax.

15 For example,

a proposal by the House Committee on Ways and

Means would treat only 70% of the distributive

share of income to a limited partner who

materially participates in the trade or business

of a partnership as subject to the SECA

tax.